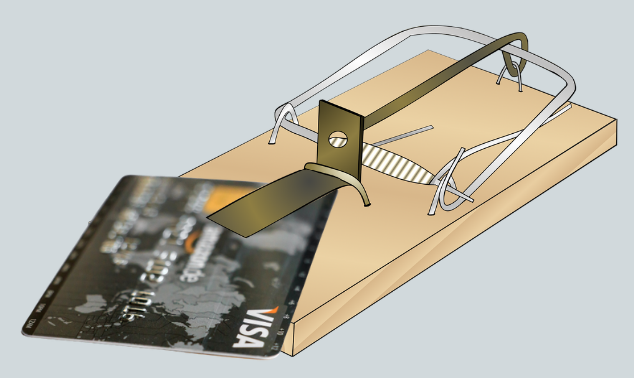

Credit cards are a double-edged sword. On one hand, they offer convenience, rewards, and the ability to build credit. On the other, they can quickly become a financial trap if not managed carefully. Many people find themselves caught in a cycle of high interest, late fees, and growing balances. This can make it harder to get ahead, especially if you’re also trying to help pay off payday loans or manage other debts.

But falling into the credit card trap isn’t inevitable. With the right habits and strategies, you can use credit cards wisely and keep your finances healthy. Here are some practical tips to help you stay on track and avoid those costly pitfalls.

Pay Off Your Full Balance Every Month

One of the simplest yet most powerful ways to avoid credit card debt is to pay your full balance every month. When you pay in full, you avoid interest charges completely. Credit card interest rates can be sky-high, so carrying a balance often means you’re paying much more than you realize.

By paying off your entire balance on time, you not only save money but also build a positive payment history, which helps your credit score.

Make Payments On Time, Always

Late payments can trigger hefty fees and penalties, and they hurt your credit score too. Even one missed payment can have a negative effect that lingers for years.

Set up reminders or automatic payments to ensure you never miss a due date. Staying on top of your payments keeps you out of trouble and gives you peace of mind.

Create and Stick to a Budget

A budget is your financial roadmap. Without one, it’s easy to overspend and lose track of how much you can really afford to pay back each month.

When you create a budget, include your credit card spending limits based on what you can comfortably pay off. This way, you won’t be tempted to spend beyond your means.

Spend Only What You Can Pay Back Right Away

Credit cards are tempting because they allow you to buy now and pay later. But that “later” can come with steep interest if you don’t pay off your balance quickly.

Make a rule for yourself: only use your credit card for purchases you can afford to pay off immediately. This habit helps you avoid carrying balances and accumulating interest.

Consider Using Cash or Debit Cards for Daily Spending

If managing credit card spending feels difficult, switch to cash or a debit card for everyday expenses. This limits you to spending money you actually have, preventing accidental overspending.

Using cash for daily purchases makes your spending more tangible, which can help you stick to your budget.

Be Wary of Minimum Payments

Making only the minimum payment on your credit card balance might seem convenient, but it can keep you in debt for years and increase the total cost of what you owe.

Try to pay more than the minimum whenever possible. This reduces your balance faster and saves you money on interest.

Avoid Using Credit Cards for Payday Loan Payments

If you’re using credit cards to help pay off payday loans, be careful. Payday loans are expensive and risky, and adding credit card debt on top of them can worsen your financial situation.

Instead, seek help from reputable debt counselors or explore debt consolidation options that offer more manageable terms.

Limit the Number of Credit Cards You Have

Having multiple credit cards can make it harder to keep track of balances and due dates. This increases the risk of missed payments and overspending.

Keep your credit cards to a manageable number and focus on using one or two responsibly.

Know Your Credit Limit and Avoid Maxing Out

Maxing out your credit cards can harm your credit score because it increases your credit utilization ratio—the percentage of your available credit you’re using.

Aim to keep your utilization below 30 percent. This signals to lenders that you’re responsible and not overextending yourself.

Final Thoughts

Avoiding the credit card trap is all about control and discipline. Paying your full balance, budgeting wisely, and spending only what you can repay right away are simple strategies that protect you from costly debt and financial stress.

If you’re working to help pay off payday loans or other debts, these habits become even more important to avoid making your situation worse.

Remember, credit cards can be useful tools, but they’re only as good as the habits you build around them.