Changing consumer expectations around checkout experiences, both online and in-store, are reshaping how retailers approach payments and security across Europe. A new report by payabl. draws on a survey of 1,400 consumers in the UK, Germany, and the Netherlands to explore shopping habits, payment preferences, and attitudes toward fraud protection.

Online Shopping Is Now Routine

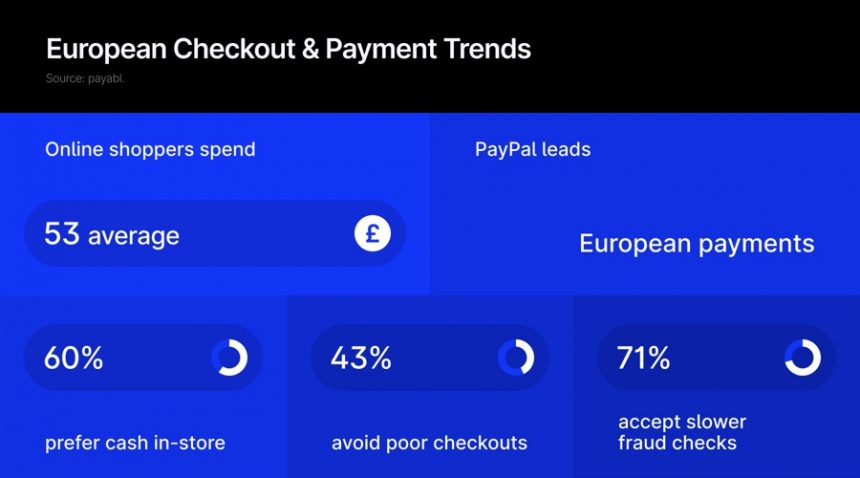

Online shopping has become routine for many, with 48% of consumers shopping online at least once a week and 42% doing so monthly. The average spend per transaction is £53, while a smaller segment, about 10%, regularly spends over £100. Most shoppers prefer to plan their purchases rather than buy on impulse, often combining orders to reduce shipping costs or for environmental reasons.

Payment Preferences Vary by Country

Payment choice plays a key role in customer satisfaction. PayPal remains the most preferred method across Europe. However, preferences differ by country. In the UK, debit cards are the top choice. In Germany, PayPal leads by a large margin. In the Netherlands, iDEAL is the most used. Consumers choose payment methods based on speed, convenience, and security. Familiarity is less important. Incentives like cashback, discounts, or faster checkout may encourage shoppers to try new methods.

Source: Payabl.

Cash Still Dominates In-Store Transactions

In stores, cash is still widely used. Sixty percent of respondents said they prefer cash for in-person purchases. Contactless cards and mobile wallets follow. Germany shows the highest preference for cash at 67%. This highlights a divide between online and offline habits.

Poor Checkout Drives Customers Away

The checkout experience strongly affects consumer behavior. 43% of respondents said a poor checkout experience would stop them from returning to a retailer. Key problems include hidden fees, forced account creation, and unclear payment steps.

The need for multi-factor authentication was a less common complaint. Interestingly, 60% of consumers said they had not abandoned a transaction in the last six months. This differs from retailer data, which often shows much higher cart abandonment rates.

Source: Payabl.

“The payment checkout experience is a critical. Offering diverse payment preferences – including cards, digital wallets, account-to-account and the appropriate selection of localised options – remove potential barriers to purchase and leave the customer with a suitably positive feeling about their experience,” David Birch, Global Ambassador for Consult Hyperion, commented.

You may find it interesting at FinanceMagnates.com: The Future of Digital Payment Trends Heading into 2025.

Security Concerns Remain High

Security remains a major concern for online shoppers. According to the report, 71% of consumers are willing to accept a slower checkout process if it provides stronger fraud protection. However, there is no clear agreement on who should be responsible for preventing fraud.

While 44% believe it is the duty of retailers, banks, or payment processors, 25% think consumers themselves should take responsibility. Another 32% are unsure. This lack of clarity suggests a need for better communication from businesses about how fraud protection works.

Interest in One-Click Checkout Grows

One-click checkout is growing in interest. About 48% are open to using it, but only if it is backed by a trusted provider like Visa or Mastercard. About 23% said they would not use one-click checkout at all.

The report suggests several steps for retailers. These include offering local payment options, reducing friction at checkout, and making all fees clear. It also recommends allowing guest checkouts and clearly explaining security measures.

Changing consumer expectations around checkout experiences, both online and in-store, are reshaping how retailers approach payments and security across Europe. A new report by payabl. draws on a survey of 1,400 consumers in the UK, Germany, and the Netherlands to explore shopping habits, payment preferences, and attitudes toward fraud protection.

Online Shopping Is Now Routine

Online shopping has become routine for many, with 48% of consumers shopping online at least once a week and 42% doing so monthly. The average spend per transaction is £53, while a smaller segment, about 10%, regularly spends over £100. Most shoppers prefer to plan their purchases rather than buy on impulse, often combining orders to reduce shipping costs or for environmental reasons.

Payment Preferences Vary by Country

Payment choice plays a key role in customer satisfaction. PayPal remains the most preferred method across Europe. However, preferences differ by country. In the UK, debit cards are the top choice. In Germany, PayPal leads by a large margin. In the Netherlands, iDEAL is the most used. Consumers choose payment methods based on speed, convenience, and security. Familiarity is less important. Incentives like cashback, discounts, or faster checkout may encourage shoppers to try new methods.

Source: Payabl.

Cash Still Dominates In-Store Transactions

In stores, cash is still widely used. Sixty percent of respondents said they prefer cash for in-person purchases. Contactless cards and mobile wallets follow. Germany shows the highest preference for cash at 67%. This highlights a divide between online and offline habits.

Poor Checkout Drives Customers Away

The checkout experience strongly affects consumer behavior. 43% of respondents said a poor checkout experience would stop them from returning to a retailer. Key problems include hidden fees, forced account creation, and unclear payment steps.

The need for multi-factor authentication was a less common complaint. Interestingly, 60% of consumers said they had not abandoned a transaction in the last six months. This differs from retailer data, which often shows much higher cart abandonment rates.

Source: Payabl.

“The payment checkout experience is a critical. Offering diverse payment preferences – including cards, digital wallets, account-to-account and the appropriate selection of localised options – remove potential barriers to purchase and leave the customer with a suitably positive feeling about their experience,” David Birch, Global Ambassador for Consult Hyperion, commented.

You may find it interesting at FinanceMagnates.com: The Future of Digital Payment Trends Heading into 2025.

Security Concerns Remain High

Security remains a major concern for online shoppers. According to the report, 71% of consumers are willing to accept a slower checkout process if it provides stronger fraud protection. However, there is no clear agreement on who should be responsible for preventing fraud.

While 44% believe it is the duty of retailers, banks, or payment processors, 25% think consumers themselves should take responsibility. Another 32% are unsure. This lack of clarity suggests a need for better communication from businesses about how fraud protection works.

Interest in One-Click Checkout Grows

One-click checkout is growing in interest. About 48% are open to using it, but only if it is backed by a trusted provider like Visa or Mastercard. About 23% said they would not use one-click checkout at all.

The report suggests several steps for retailers. These include offering local payment options, reducing friction at checkout, and making all fees clear. It also recommends allowing guest checkouts and clearly explaining security measures.